In the world of business, understanding the dynamics of profitability is crucial for making informed decisions. Profit Volume Ratio (PV Ratio Formula), often referred to as the Contribution Margin or Contribution Ratio, is a fundamental concept that plays a important role in examine the financial health of a business. In this comprehensive guide, we will delve into the depths of PV Ratio Formula, breaking down complex ideas into easily digestible concepts.

Introduction to PV Ratio Formula in Cost Accounting

The Profit Volume Ratio (PV Ratio Formula) helps you figure that out. It’s like a magic number that tells you how much of your sales turn into profit after covering your costs.

What is Profit Volume Ratio (PV Ratio Formula) ?

Profit Volume Ratio (PV Ratio) Ratio is a financial measurement that shows the relationship between a company’s sales revenue and its profitability.It’s a percentage that shows how much money a company makes after paying its bills, like rent and salaries.

Imagine you run a panipuri stand. You sell each panipuri for ₹2, and it costs you ₹1 to make each panipuri. If you sell 100 panipuri in a day, your total revenue is ₹200, and your total variable costs are ₹100. The remaining ₹100 goes towards covering your fixed costs (like rent, utilities, and salaries) and generating a profit. In this case, your PV Ratio would be 50% because half of your revenue contributes to profit.

Components of PV Ratio Formula

To understand PV Ratio Formula better, let’s break it down into its key components:

Sales Revenue

Sales revenue is the total income generated from selling goods or services. It’s the initial point for calculating PV Ratio. This figure represents the top line of a company’s income statement.

Variable Costs

Variable costs are the expenses that vary directly with the level of production or sales. In our panipuri stand example, the cost of panipuri, sugar, cups, and labor to make each panipuri are variable costs. They increase as you sell more panipuri.

Contribution Margin Formula

The contribution margin is the difference between sales revenue and variable costs. It’s the amount available to cover fixed costs for generate the profit. In other words, it’s the “contribution” of each sale to profit.

Contribution margin=(Sales revenue – Variable cost)

Calculation of PV Ratio Formula

Now, let’s understand how to calculate PV Ratio. The formula is simple:

PV Ratio=(Contribution Margin/sales revenue)×100

Let’s go back to our panipuri stand example to calculate the PV Ratio:

- Sales Revenue = ₹200

- Variable Costs = ₹100

- Contribution Margin = ₹200 – ₹100 = ₹100

Using the PV Ratio formula:

PV Ratio=(100/200)*100= 50%

So, the PV Ratio for your panipuri stand is 50%. This means that for every Rupee of sales revenue, 50 cents contribute to covering fixed costs and generating profit.

Relationship between Contribution and PV Ratio Formula

If PV Ratio as per calculation is 60% of sales means that contribution is (100-60) 40% of total sale.

Contribution Change in Sales

The Profit Volume Ratio (PV Ratio) Ratio or Contribution Margin Ratio formula allows you to calculate how changes in sales affect your contribution margin. It helps you analyze the impact of changes in sales volume on your profitability.

Here’s the formula:

Contribution Change in Sales = Change in Sales × PV Ratio

Where:

- Change in Sales is the difference in sales revenue between two different levels (new and original) of sales.

- PV Ratio is the Profit-Volume Ratio or Contribution Margin Ratio, which is expressed as a percentage.

Here’s a step-by-step breakdown of how to use this formula:

- Determine the original level of sales (let’s call it Original Sales) and the corresponding profit (Original Profit).

- Determine the new level of sales (let’s call it New Sales) and the corresponding profit (New Profit).

- Calculate the Change in Sales by subtracting the Original Sales from the New Sales:Change in Sales = New Sales – Original Sales

- Calculate the PV Ratio. To do this, you’ll first need to find the Contribution Margin, which is the difference between the contribution (profit) and variable costs. Then, divide the Contribution Margin by the Original Sales and multiply by 100 to express it as a percentage:PV Ratio = (Contribution Margin / Original Sales) × 100

- Finally, use the formula to calculate the Contribution Change in Sales:Contribution Change in Sales = Change in Sales × PV Ratio

This calculation will give you the contribution change in profit resulting from the change in sales. It helps you understand how sensitive your profit is to changes in sales volume.

Interpreting PV Ratio

High vs Low PV Ratio

PV Ratio can vary from one business to another and can provide valuable insights into its financial rep/ort.

High PV Ratio

A high PV Ratio (e.g., 90%) indicates that a significant portion of each sale contributes to profit after covering variable costs. It implies a healthy and profitable business model.

Low PV Ratio

A low PV Ratio (e.g., 10%) suggests that a smaller proportion of sales revenue is available for covering fixed costs and generating profit. It might indicate a business that struggles with high variable costs with generating the profit.

Relationship with Profit

PV Ratio is directly proportional to a company’s profit. As the PV Ratio increases, the profit also increases, assuming fixed costs remain constant. Conversely, a lower PV Ratio means lower profit.

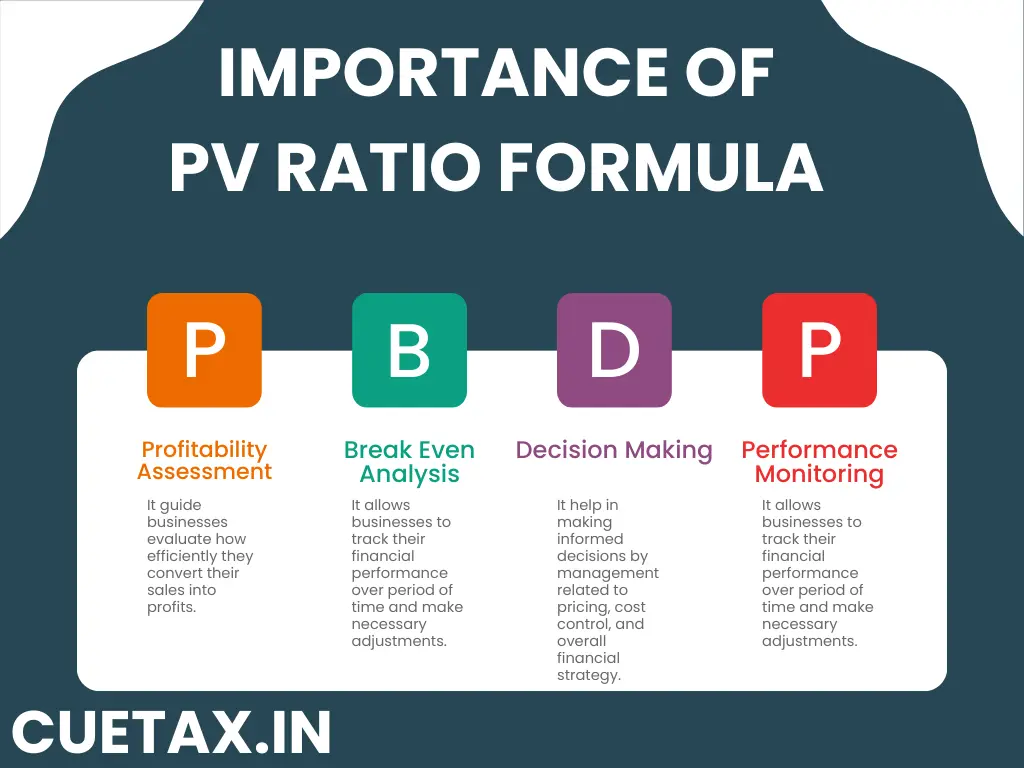

Benefit of PV Ratio

The Profit Volume Ratio (PV Ratio) Ratio, also known as the Contribution Margin Ratio, offers several benefits to businesses and individuals in financial analysis and decision-making. Here are some key benefits of using the PV Ratio:

Profitability Assessment

PV Ratio provides a clear and straightforward measure of a company’s profitability. It indicates the proportion of sales revenue that contributes to covering fixed costs and generating profits. A higher PV Ratio signifies better profitability, while a lower ratio suggests that a larger portion of sales is needed to cover fixed costs.

Decision Making

PV Ratio is a valuable tool for making informed decisions in various aspects of business, including pricing strategies, product or service mix, cost control, and resource allocation. By understanding how changes in sales volume or prices affect the PV Ratio, businesses can make decisions that optimize their profitability.

Pricing Strategies

Businesses can use PV Ratio analysis to set prices for their products or services. If a product has a high PV Ratio, the business may decide to price it higher to maximize profit margins. Conversely, products with lower PV Ratios may be priced more competitively to attract a larger customer base.

Break Even Analysis

PV Ratio is crucial for calculating the break-even point, which is the level of sales at which a company covers all its fixed costs and neither makes a profit nor incurs a loss. This analysis helps businesses set sales targets and understand the minimum level of activity required to remain financially viable.

Performance Monitoring

Over time, monitoring changes in the PV Ratio can help businesses track their financial performance. A decreasing PV Ratio may indicate rising variable costs or pricing issues, prompting businesses to take corrective actions.

Resource Allocation

By calculating the PV Ratio for different product lines or services, companies can allocate resources more effectively. They can focus on promoting or improving products with higher PV Ratios to maximize profitability.

Cost Control

Understanding the variable costs associated with each product or service allows businesses to identify cost-saving opportunities. They can work on reducing variable costs without negatively affecting the quality of their offerings, which can lead to an improved PV Ratio and increased profitability.

Strategic Planning

- The PV Ratio is a valuable tool for long-term strategic planning. It helps businesses set realistic financial goals, assess the impact of various scenarios, and create financial projections.

- Investor and Stakeholder Communication: When communicating with investors, shareholders, or stakeholders, businesses can use the PV Ratio to provide insights into their financial performance and profitability trends. It can enhance transparency and help stakeholders make informed decisions.

- Comparative Analysis: PV Ratios can be compared across different time periods, business segments, or competitors within the industry. Such comparisons provide valuable insights into relative performance and can guide benchmarking and competitive strategies.

Risk Management

A strong understanding of PV Ratios can aid in risk assessment and management. Businesses can identify scenarios where changes in sales volume or costs may put their profitability at risk and take preemptive measures to mitigate those risks.

Cost Volume Profit (CVP) Analysis

PV Ratio is a fundamental component of CVP analysis, which allows businesses to analyze how changes in sales volume, prices, and costs impact their profitability. It’s an essential tool for evaluating different business strategies and scenarios.

In summary, the Profit Volume Ratio (PV Ratio) Ratio is a versatile financial metric that offers a wide range of benefits for businesses. It assists in assessing profitability, making informed decisions, setting prices, and optimizing resource allocation. By incorporating PV Ratio analysis into financial planning and decision-making processes, businesses can enhance their financial performance and competitiveness.

Applications of PV Ratio Formula

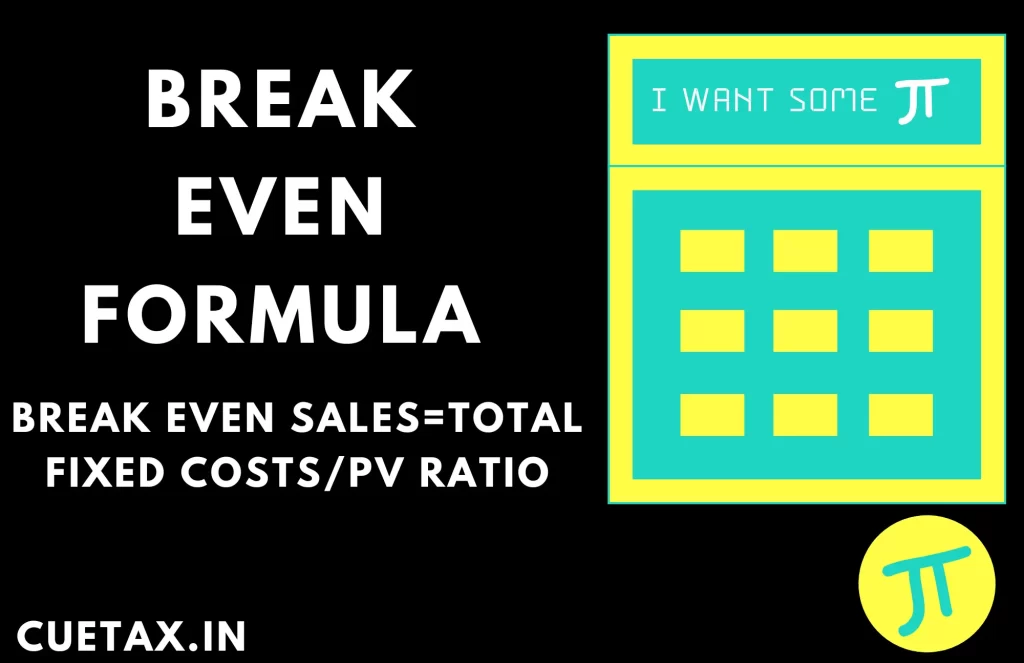

Break Even Analysis

One of the most practical applications of PV Ratio Formula is in break even analysis. The break even point is the level of sales at which a company neither makes a profit nor incurs a loss. It can be calculated using the following formula:

Break Even Sales=Total Fixed Costs/PV Ratio

Knowing the break even point is imperative for businesses because it helps them set sales targets and determine when they can become a profitable.

Decision Making

PV Ratio is a valuable tool for decision making, especially in pricing strategies. By understanding how changes in price or volume affect the PV Ratio, businesses can make informed decisions on pricing adjustments proactively.

For example, if you lower the price of your panipuri to ₹1.50 per glass but expect to sell 150 glasses, you can use the PV Ratio to assess the impact on your profit.

Pricing Strategies

PV Ratio can guide businesses in setting prices that not only cover costs but also maximize profit. For instance, if a product has a high PV Ratio, a business may consider setting a lower price to attract more customers and increase sales volume.

Limitations of PV Ratio

While PV Ratio is a valuable tool, it has its limitations:

Assumption of Linear Behavior

PV Ratio Formula assumes that variable costs remain constant per unit, which may not always be the case in the real world.

Ignoring Other Factors

It doesn’t consider external factors like competition, market demand, and economic conditions that can impact profitability.

Fixed Costs Variability

In some businesses, fixed costs can vary over time, making the break-even analysis less accurate.

Applications of PV Ratio in Different Industries

PV Ratio is a versatile concept that finds applications across a wide range of industries. Let’s take a look at how it is used in a few sectors:

Manufacturing Industry

In manufacturing, PV Ratio is used to determine the profitability of different product lines. By calculating the PV Ratio for each respective product, companies can identify which products are generating the more profits and allocate resources accordingly. This helps in optimizing production and pricing strategies.

Retail Industry

Retailers often use PV Ratio to determine the pricing of each products. For instance, during a clearance sale, they might reduce prices to attract more customers and increase sales volume, even if it means a lower PV Ratio for those products. On the other hand, premium products may have a higher PV Ratio, allowing retailers to maintain higher profit margins.

Service Industry

Service-based businesses like consulting firms or software as a service (SaaS) providers can also benefit from PV Ratio analysis. They can use it to assess the profitability of different service offerings and adjust their pricing or resource allocation accordingly and change strategy.

Hospitality Industry

Hotels and restaurants can use PV Ratio Formula to assess the profitability of different dishes on their menu. By calculating the PV Ratio for each item, they can identify which dishes contribute most to their profits and may choose to promote or adjust their menu accordingly for future reference.

Healthcare Industry

In healthcare, PV Ratio can be applied to analyze the profitability of medical procedures, services, or treatment plans offered by hospitals and clinics. This helps in making decisions about resource allocation and pricing strategies.

Variation in PV Ratio Formula

While the basic concept of PV Ratio remains consistent, there are some nuances to consider when applying it in real-world scenarios:

Multiple Products or Services

In businesses with multiple products or services, each product or service may have a different PV Ratio. It’s important to calculate and analyze the PV Ratio for each product separately to make informed decisions about resource allocation, pricing, and promotion.

Seasonal Variations

Businesses that experience seasonal fluctuations in sales should consider the seasonal variations in PV Ratio. What works in one season may not be applicable in another. Understanding the PV Ratio for each season helps in planning and budgeting.

Competition and Market Dynamics

External factors, such as changes in the competitive landscape or shifts in consumer preferences, can impact a business’s PV Ratio. It’s essential to monitor these factors and adjust strategies accordingly.

Fixed Costs Changes

In some cases, fixed costs may change over time. When calculating the break-even point or assessing profitability, it’s crucial to use the most accurate fixed cost figures available.

Economies of Scale

As businesses grow and produce larger quantities, they may benefit from economies of scale, which can lead to lower variable costs per unit. This, in turn, can improve the PV Ratio and profitability.

Conclusion

In this comprehensive guide, we’ve explored Profit Volume Ratio (PV Ratio Formula), a crucial concept in understanding the financial health of a business. We’ve learned that it represents the relationship between sales revenue, variable costs, and profit, and it plays a vital role in decision making, pricing strategies, and break-even analysis.

By mastering the PV Ratio, businesses can make informed financial decisions, set realistic goals, and ultimately strive for greater profitability. While it’s a powerful tool, it’s essential to remember that PV Ratio is just one piece of the financial puzzle, and a holistic view of a company.

Frequently Ask Question

PV ratio = (Contribution Margin / Sales Revenue) x 100

A higher PV ratio suggests that the company is making a greater profit for each unit of sales it generates. On the other hand, a lower PV ratio may signal that the company should reassess its pricing approach, find ways to cut costs, or boost sales to enhance its overall profitability.

The highest PV Ratio is best for any product comparison.

Yes, it suggest that variable cost is greater than sale.

A cost sheet is like a detailed list that shows all the different expenses a company has when it makes a product or provides a service. It includes things like how much it costs for materials, workers, and other stuff needed to run the business. It also shows how much the company sells the product or service for and how much profit it makes. Cost sheets help businesses keep track of their costs and figure out if they are making money.

thanks i have understand all about of PV ratio formula

Thanks for valuable comment